43 ytm for coupon bond

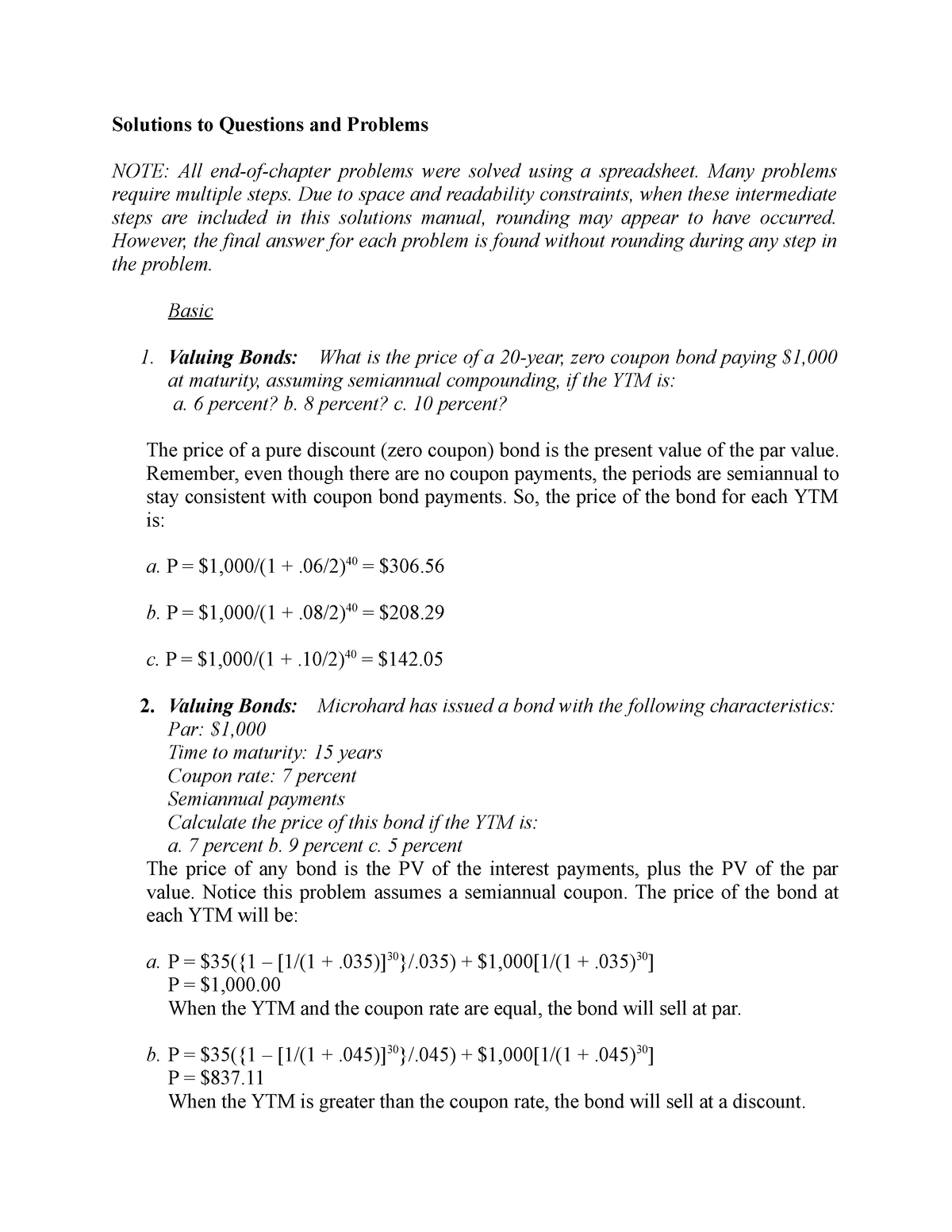

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity Yield to Call Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600 Par Value: $1000 Years to Maturity: 3 Annual Coupon Rate: 0% Coupon Frequency: 0x a Year Price = (Present Value / Face Value) ^ (1/n) - 1 = (1000 / 600) ^ (1 / 3) - 1= 1.6666... ^ (1/3) - 1 = 18.563%

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments.

Ytm for coupon bond

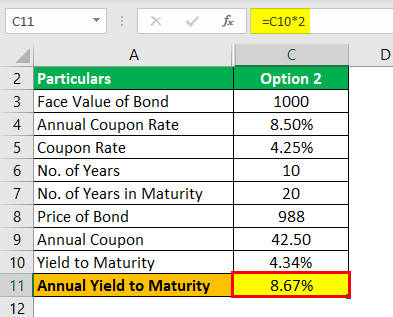

YTM of Coupon Bond | Bond Valuation Lecture 4 - YouTube This video first explains the concept of current yield and then we delve into the understanding of yield to maturity of a coupon bond. We can estimate the ytm of a coupon bond using two... Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Use the below-given data for the calculation of YTM. We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands trading in the US market.

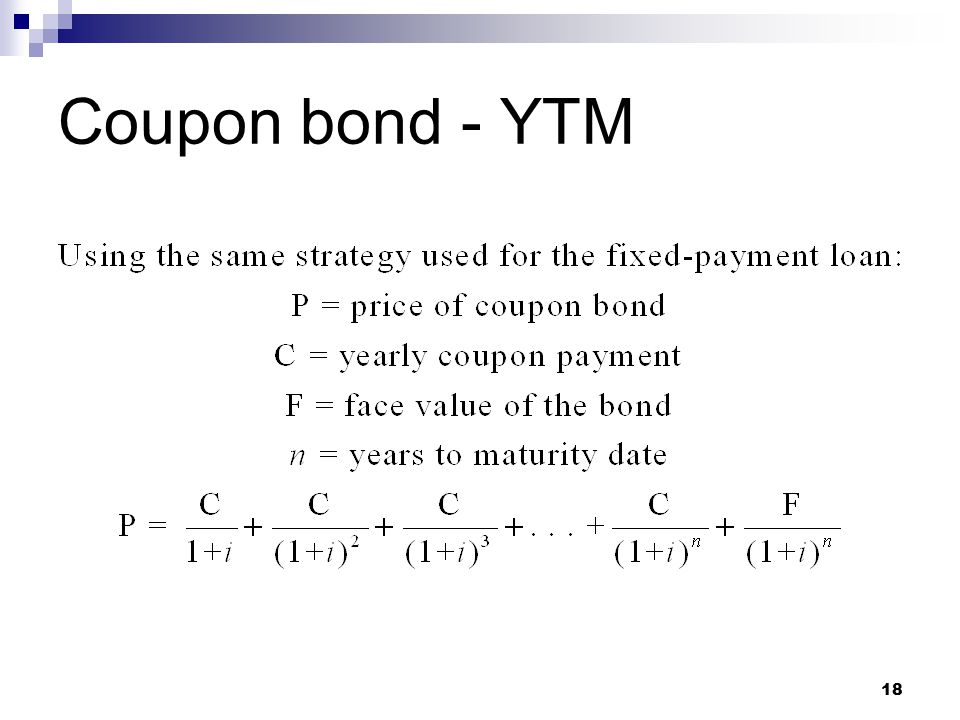

Ytm for coupon bond. Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... How to calculate YTM in Excel | Basic Excel Tutorial Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2. Write the following words from cells A2 -A5. Future Value, Annual Coupon rate, Years to maturity, and Bond Price 3. How to Calculate the Price of Coupon Bond? - WallStreetMojo Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc., Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents What is Coupon Bond Formula?

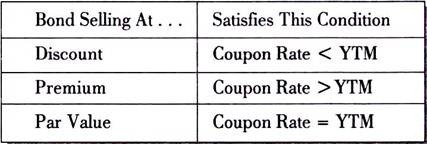

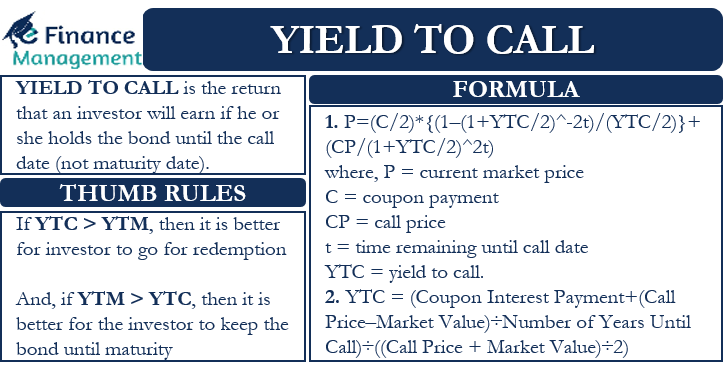

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). What is Yield to Worst? (YTW Formula + Calculator) - Wall Street Prep Frequency of Coupon: 1 Coupon Rate: 6% Annual Coupon: $60 Now, we'll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)" Step 4. Yield to Worst Calculation Analysis (YTW) What is Yield to Maturity? (YTM Formula + Calculator) - Wall Street Prep YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. YTM > Coupon Rate and Current Yield → The bond is being sold at a "discount" to its par value. YTM = Coupon Rate and Current Yield → The bond is said to be "trading at par". How to Interpret YTM in Bond Percent Yield Analysis Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are...

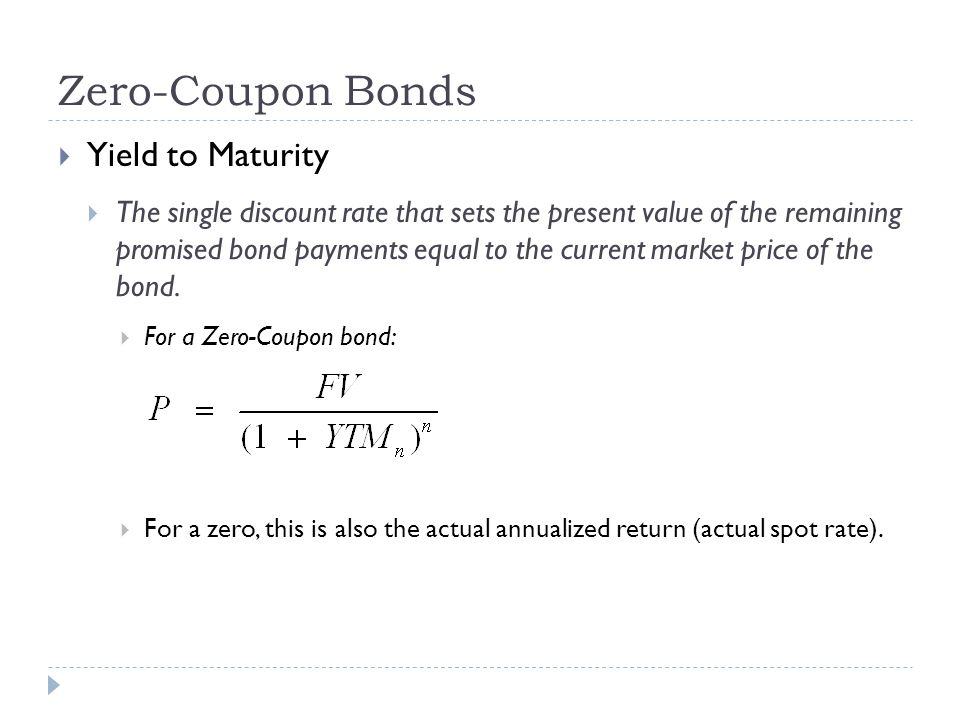

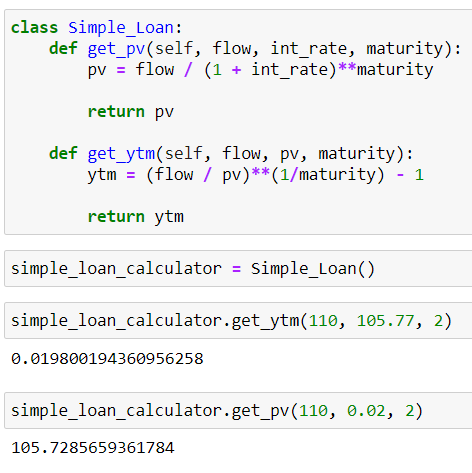

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ).

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the...

Yield To Maturity (YTM) - Formula & Calculation | IndiaBonds Know Yield & Yield To Maturity (YTM) together with its Formula & Calculation process. Visit now to learn how to interpret YTM & its Role at IndiaBonds. ... For instance, if a corporate bond has a coupon rate of 10%, that means the bond will pay us interest coupon payments of @10% per annum. But is it always the actual interest that we earn?

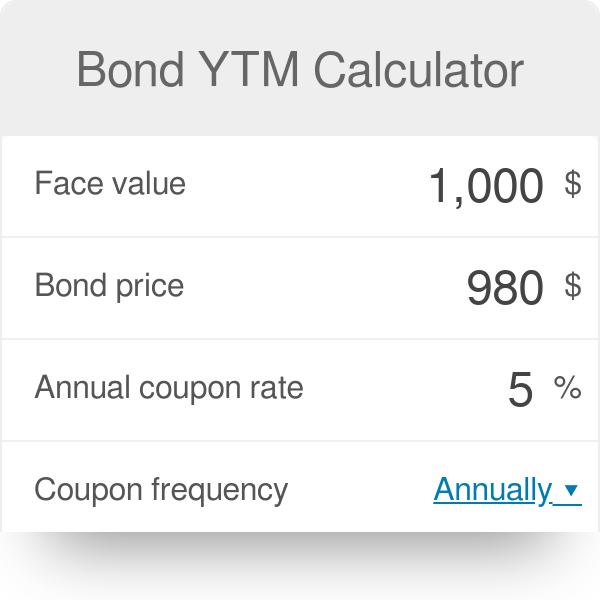

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

What are Zero-Coupon Bonds? (Characteristics + Calculator) Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price.

Yield to Maturity Calculator | Calculate YTM The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond\ price = \sum_ {k=1}^ {n} \frac {cf} { (1+r)^k} bond price = k=1∑n (1 + r)kcf where:

Zero-Coupon Bond - Definition, How It Works, Formula The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity.

YTM for a 0-coupon Bond with <1 year until Maturity : r/bonds YTM for a 0-coupon Bond with <1 year until Maturity Anyone mind helping me walk through this calculation? I can't quite arrive at my broker's number, so I am trying to reverse it back out but still can't get this exact. For reference, the bond I'm referring to: Face Value: $75,000 Price: $73,620 Purchase Date: 9/15/22 Maturity Date: 3/16/23

Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon...

Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a financial calculator. Show...

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Use the below-given data for the calculation of YTM. We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands trading in the US market.

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

YTM of Coupon Bond | Bond Valuation Lecture 4 - YouTube This video first explains the concept of current yield and then we delve into the understanding of yield to maturity of a coupon bond. We can estimate the ytm of a coupon bond using two...

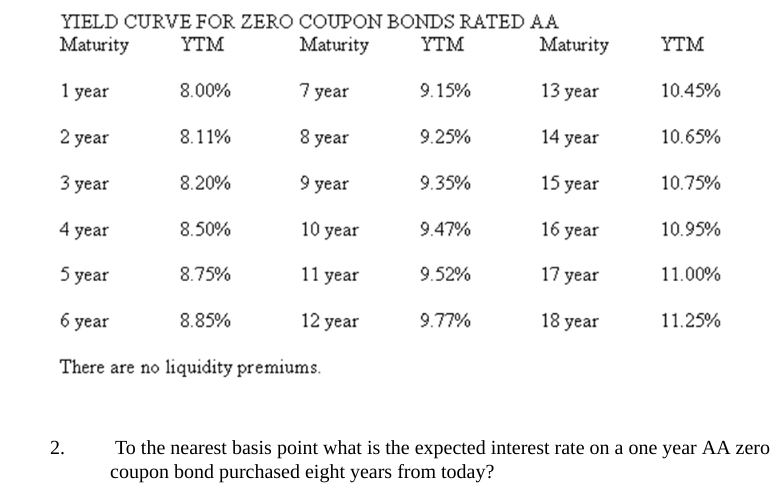

The yield to maturity (YTM) on 1-year zero-coupon bond is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year maturity coupon bonds with coupon rates of 12% (paid annually) is 5.8%. ...

![PDF] Yield to Maturity Is Always Received as Promised: A Reply](https://i1.rgstatic.net/publication/228510503_Yield_to_Maturity_Is_Always_Received_as_Promised_A_Reply/links/00b7d5182ee3b9fafb000000/largepreview.png)

Post a Comment for "43 ytm for coupon bond"