45 pricing zero coupon bonds

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

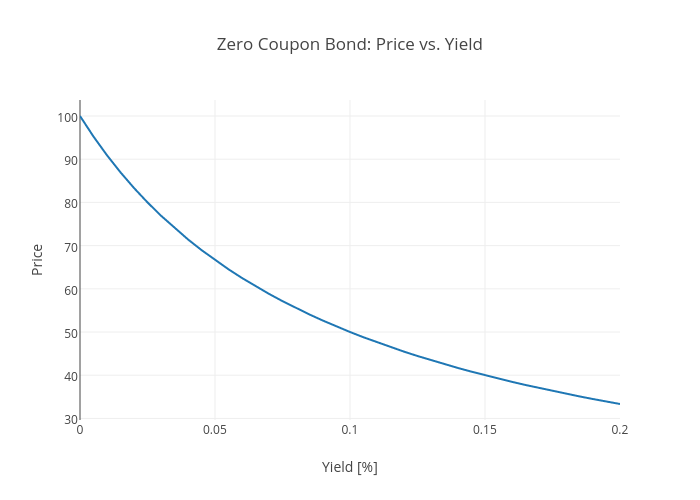

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually ...

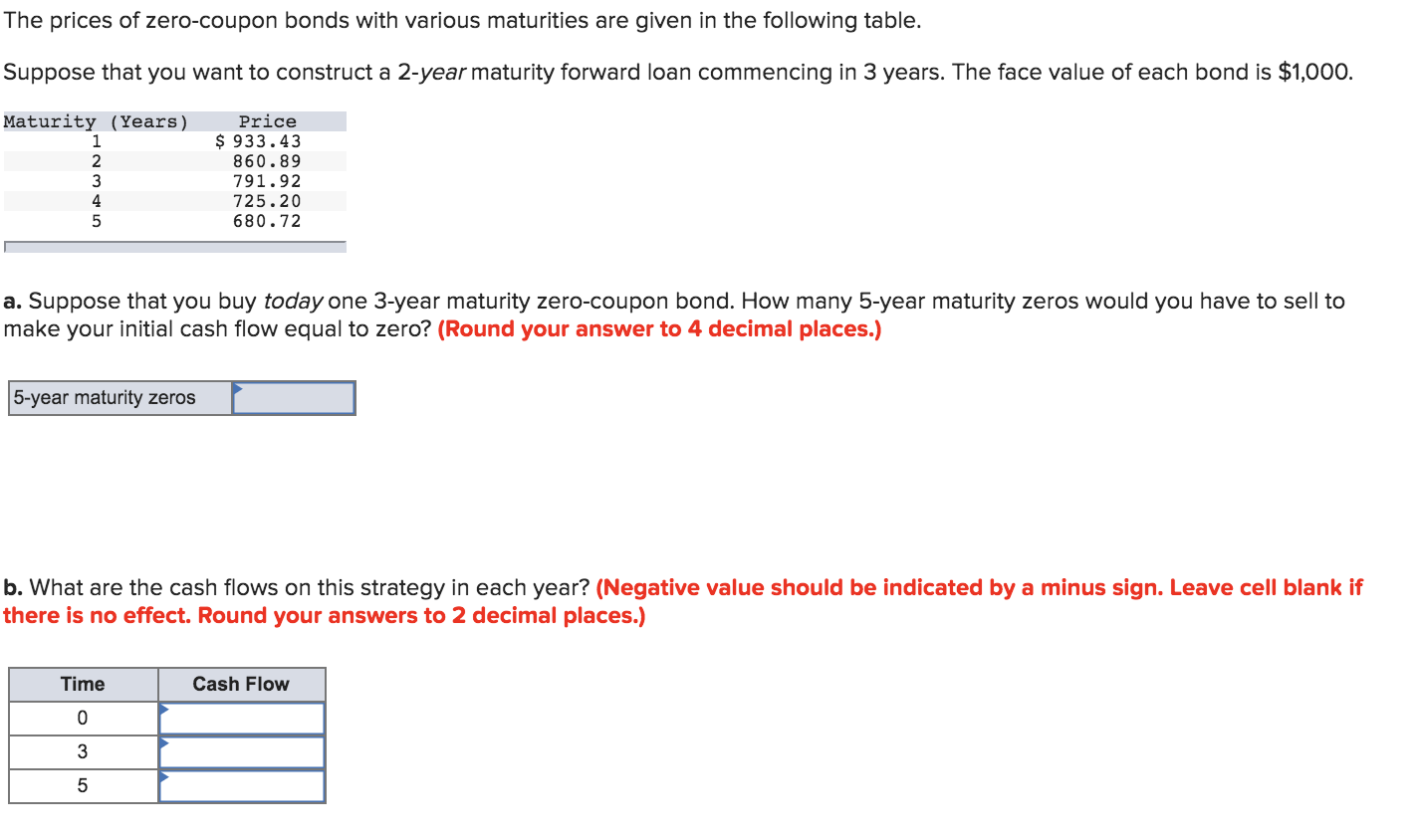

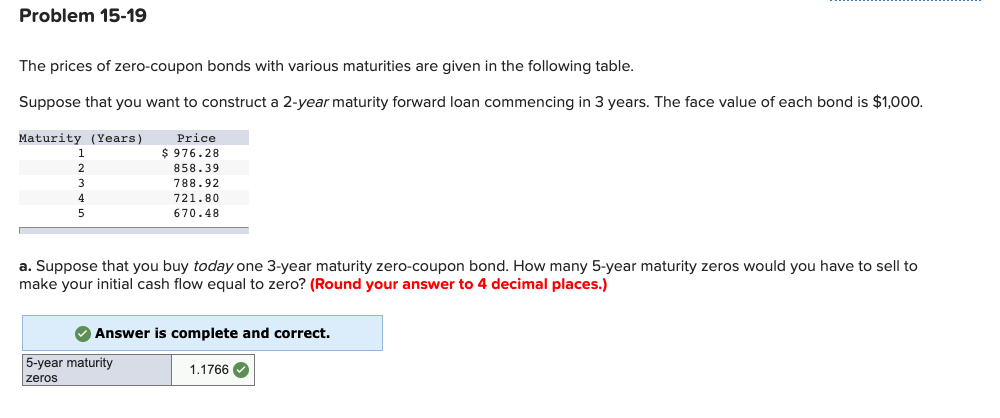

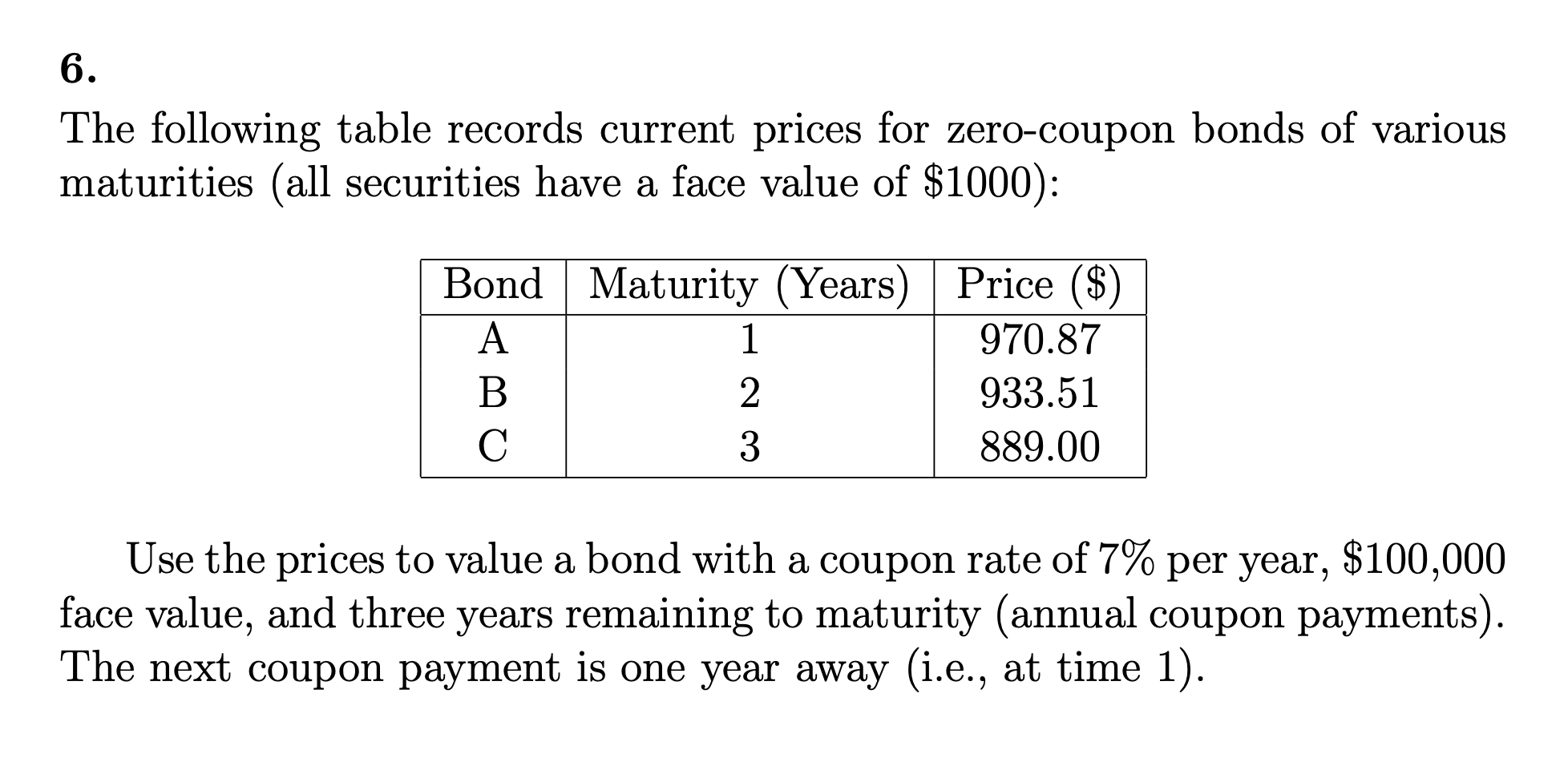

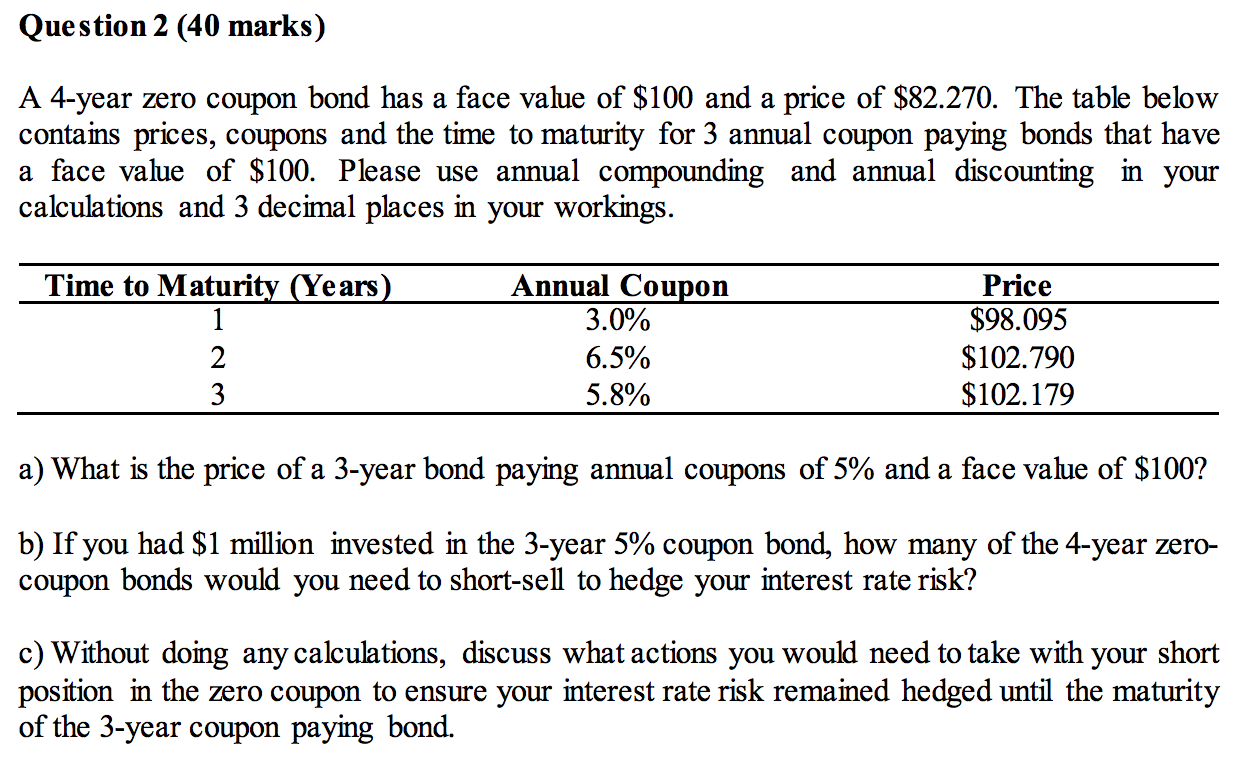

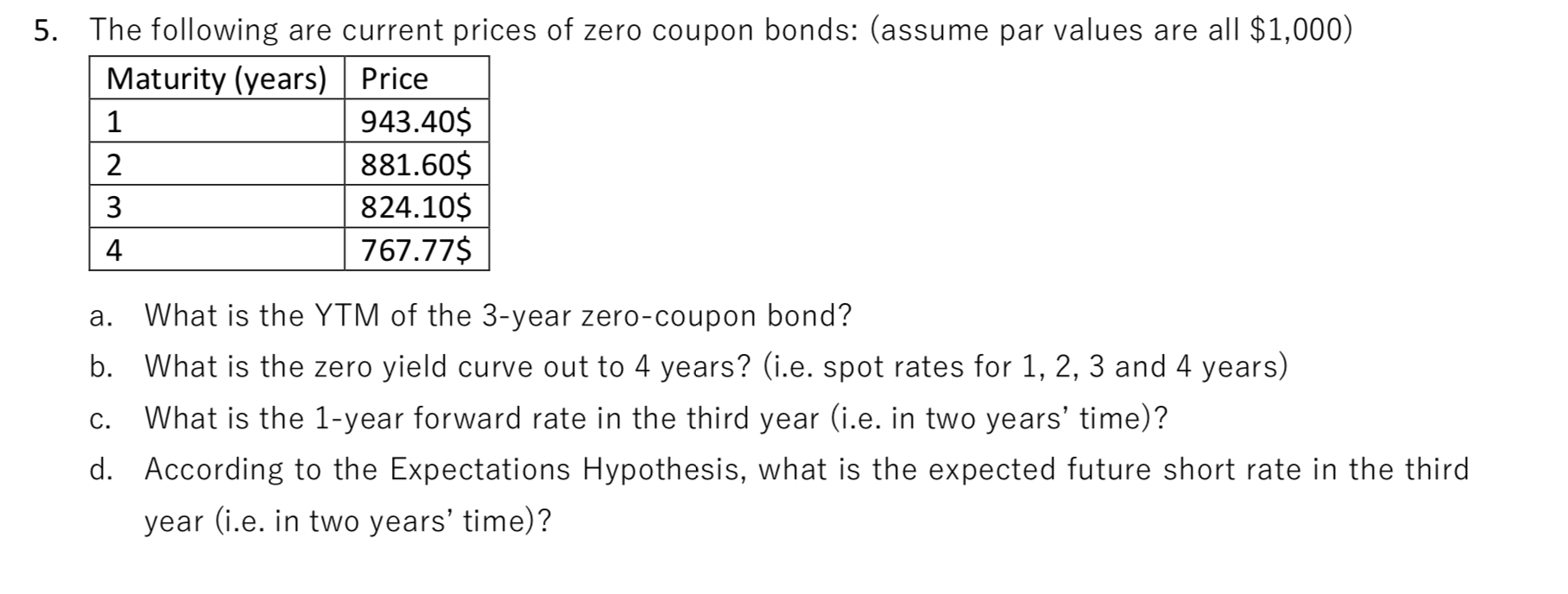

Pricing zero coupon bonds

Financial economics - Wikipedia An immediate extension, Arbitrage-free bond pricing, discounts each cashflow at the market derived rate – i.e. at each coupon's corresponding zero-rate – as opposed to an overall rate. In many treatments bond valuation precedes equity valuation , under which cashflows (dividends) are not "known" per se . United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Latest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Pricing zero coupon bonds. Bond Pricing - Formula, How to Calculate a Bond's Price Jan 21, 2022 · Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to maturity. Bond Pricing: Yield to Maturity. Bonds are priced to yield a certain ... Latest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Financial economics - Wikipedia An immediate extension, Arbitrage-free bond pricing, discounts each cashflow at the market derived rate – i.e. at each coupon's corresponding zero-rate – as opposed to an overall rate. In many treatments bond valuation precedes equity valuation , under which cashflows (dividends) are not "known" per se .

Post a Comment for "45 pricing zero coupon bonds"