44 what is zero coupon bonds

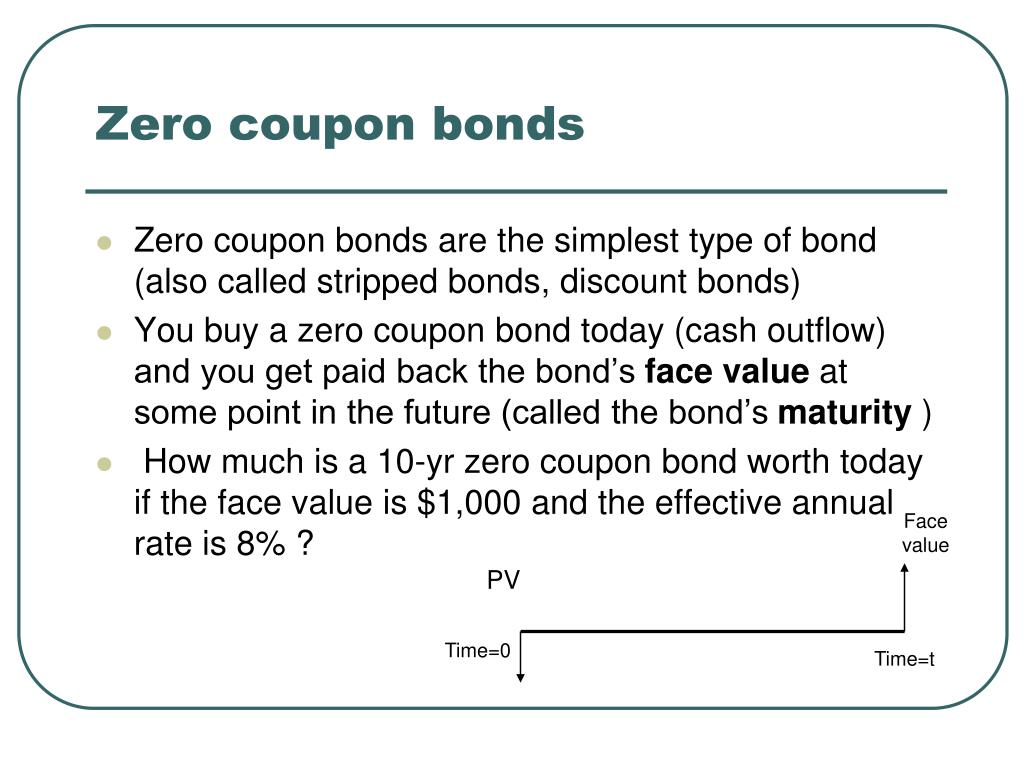

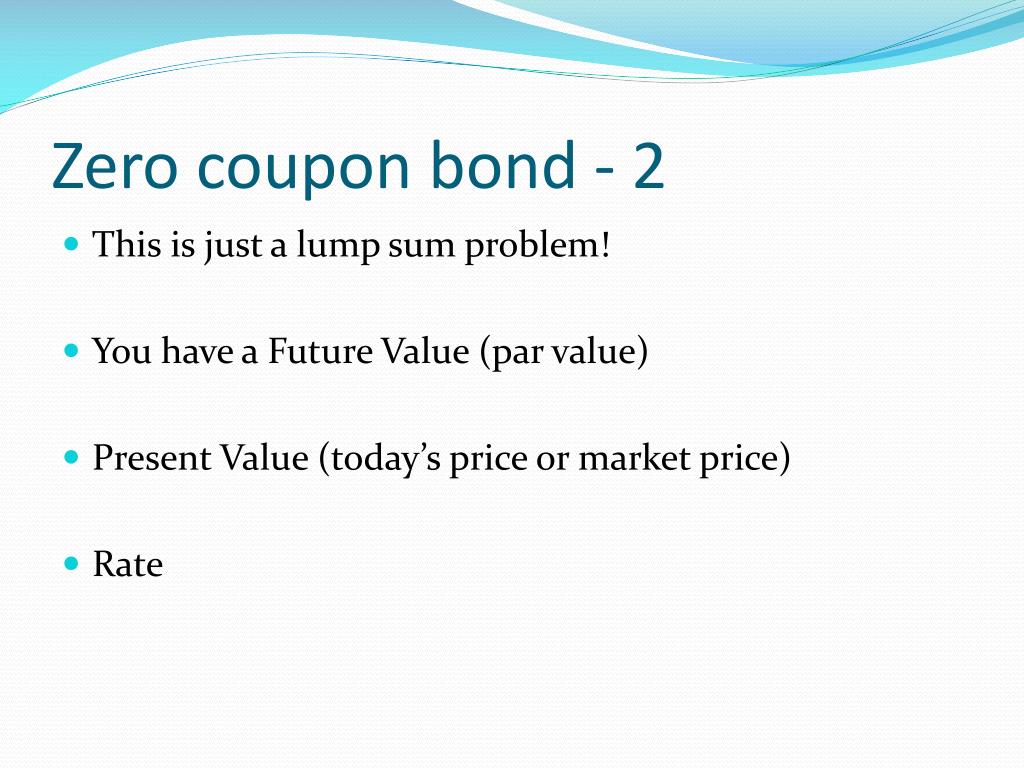

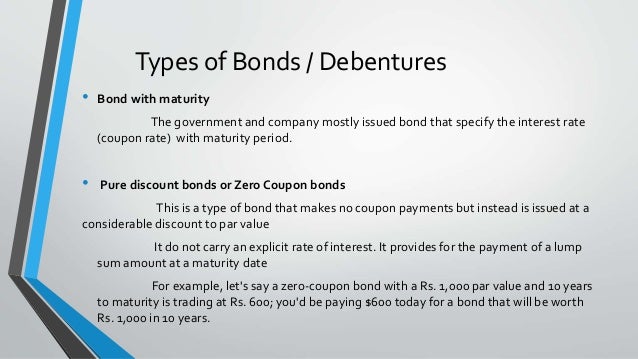

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

What is zero coupon bonds

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero Coupon Bond - Explained - The Business Professor, LLC A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value. The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable.

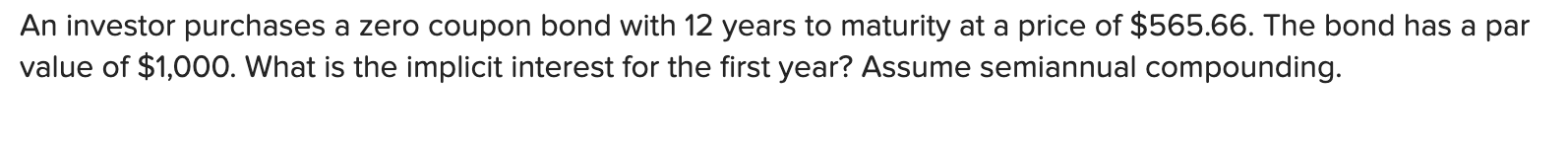

What is zero coupon bonds. How is a zero-coupon bond taxed? A zero-coupon bond is a discounted investment that can help you save for a specific future goal. A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs at a foreseeable time. ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero Coupon Bond Definition - What Does Zero Coupon Bond Mean? Zero Coupon Bond Definition and Legal Meaning. On this page, you'll find the legal definition and meaning of Zero Coupon Bond, written in plain English, along with examples of how it is used. What is Zero Coupon Bond? What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond.

Zero Coupon Bond - Explained - The Business Professor, LLC A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value. The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable. Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Post a Comment for "44 what is zero coupon bonds"